Volatility Contraction Pattern

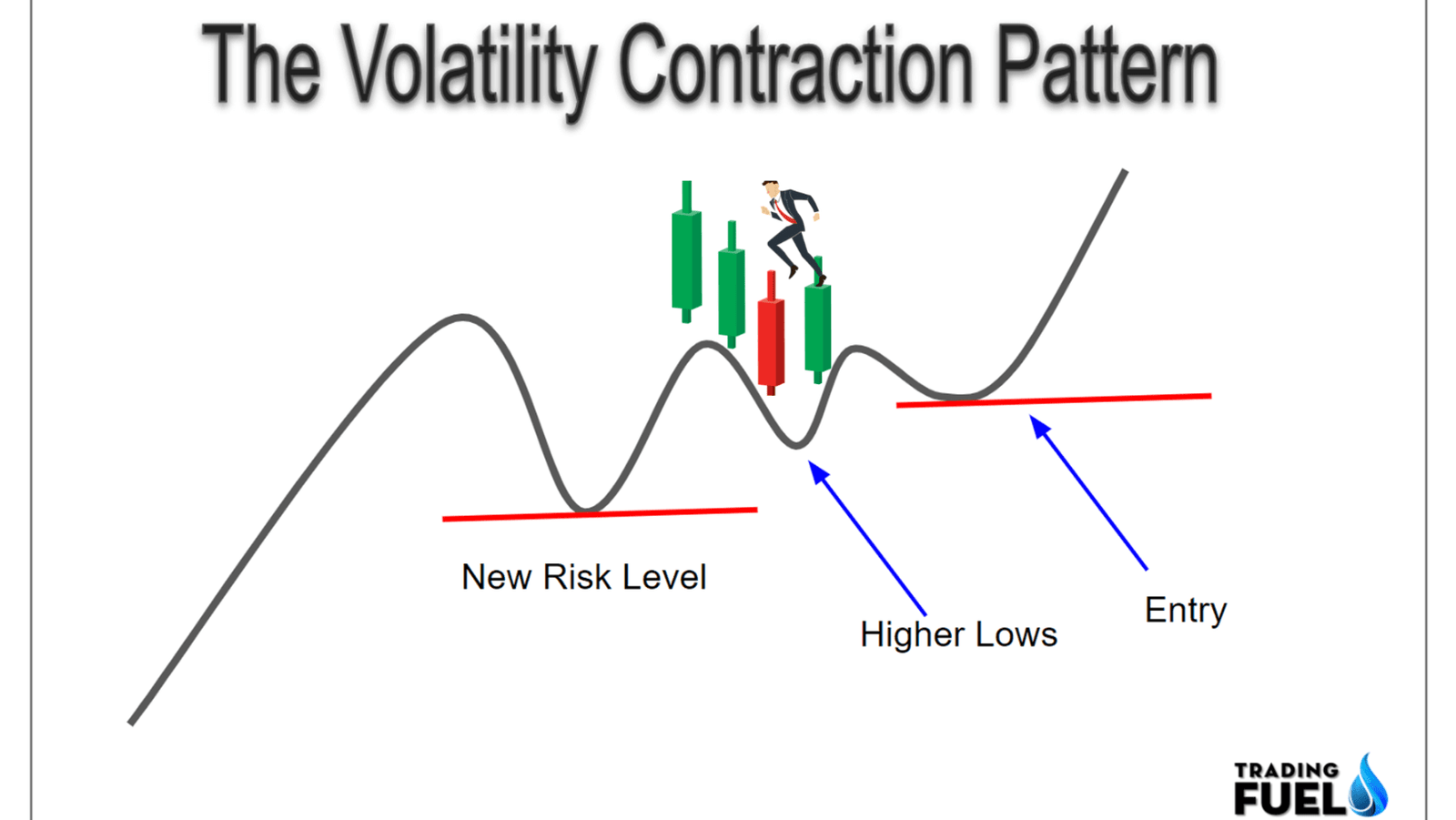

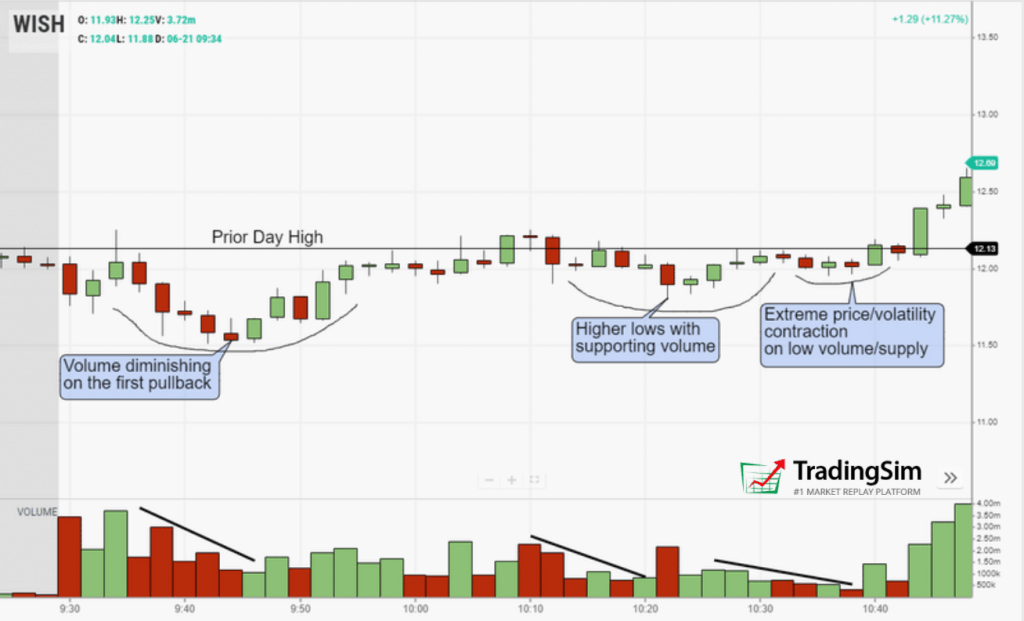

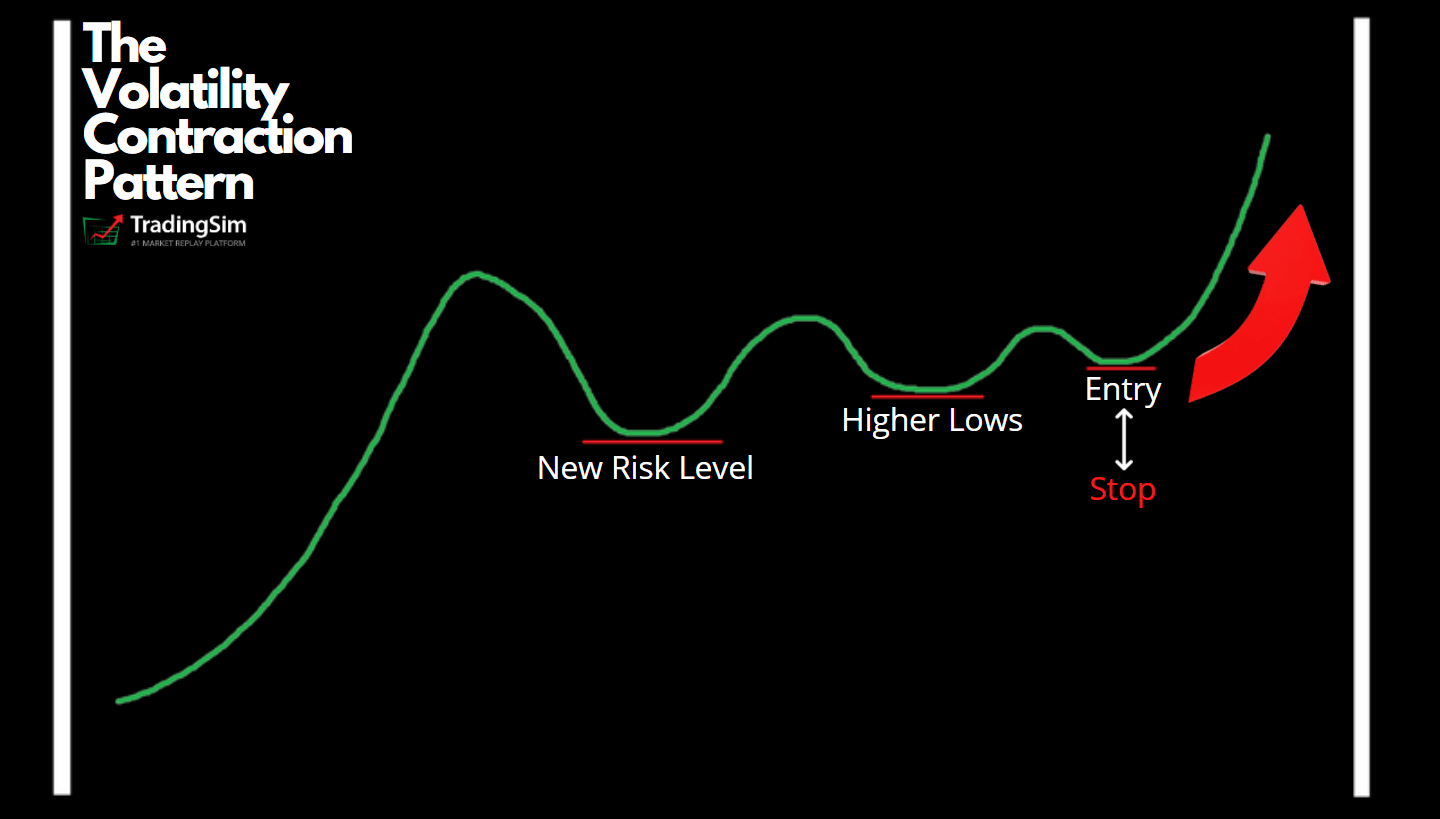

Volatility Contraction Pattern - This tutorial covers the criteria of a vcp base, how to filte. When prices decrease in both volatility and volume, the price will form a contracted pattern which is better illustrated using a bollinger band indicator. Web the vcp or volatility contraction pattern is a trading tactic coined by professional investor, mark minvervini. To that point, there is no easier way to spot that demand than a. It is essentially about appreciating price and volume action as supply diminishes during a price base. This pattern emerges when there is a decrease in a stock’s volatility after a significant price move, typically following a period of consolidation. Web a volatility contraction pattern (vcp) is a chart consolidation that tightens from left to right within a price base. Web what is the volatility contraction pattern? In simplest words, prices of financial instruments form a contracted pattern when prices move sideways, volatility declines, and volume also decreases. Web volatility contraction patterns are often found in stocks before an explosive share price gain. Web a volatility contraction pattern is a pattern that forms during a consolidation period. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. Web the vcp or volatility contraction pattern is a trading tactic coined by professional investor, mark minvervini. In simplest words, prices of financial instruments form a contracted pattern when prices move sideways, volatility declines, and volume also decreases. This pattern emerges when there is a decrease in a stock’s volatility after a significant price move, typically following a period of consolidation. This tutorial covers the criteria of a vcp base, how to filte. Web the volatility contraction pattern (vcp) is a powerful trading pattern that has gained popularity and recognition among traders around the globe. Web what is the volatility contraction pattern (vcp pattern)? When prices decrease in both volatility and volume, the price will form a contracted pattern which is better illustrated using a bollinger band indicator. Web what is the volatility contraction pattern? Web in technical analysis, the volatility contraction pattern (vcp) is a notable concept that traders use to identify potential breakouts in stock prices. For a stock to create the proper setup for the vcp, there needs to be demand. Web what is the volatility contraction pattern? To that point, there is no easier way to spot that demand than a.. For the volatility contraction pattern, the stock must be in demand. Web the volatility contraction pattern (vcp) is a powerful trading pattern that has gained popularity and recognition among traders around the globe. Web what is the volatility contraction pattern (vcp pattern)? And a lot of it. To that point, there is no easier way to spot that demand than. This means buyers should be active in the particular stock. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. Web the volatility contraction pattern (vcp) is a powerful trading pattern that has gained popularity and recognition among traders around the globe. It is essentially about appreciating price and volume action as supply diminishes. Web a volatility contraction pattern (vcp) is a chart consolidation that tightens from left to right within a price base. Web in technical analysis, the volatility contraction pattern (vcp) is a notable concept that traders use to identify potential breakouts in stock prices. This pattern emerges when there is a decrease in a stock’s volatility after a significant price move,. For the volatility contraction pattern, the stock must be in demand. Web a volatility contraction pattern (vcp) is a chart consolidation that tightens from left to right within a price base. It's essentially a supply and demand characteristic that creates this chart pattern. Web a volatility contraction pattern is a pattern that forms during a consolidation period. Web the vcp. Web the volatility contraction pattern (vcp) is a powerful trading pattern that has gained popularity and recognition among traders around the globe. It is essentially about appreciating price and volume action as supply diminishes during a price base. To that point, there is no easier way to spot that demand than a. Web what is the volatility contraction pattern? This. This tutorial covers the criteria of a vcp base, how to filte. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. It's essentially a supply and demand characteristic that creates this chart pattern. The main role of the vcp pattern is. Web a volatility contraction pattern (vcp) is a chart consolidation that tightens. Web what is the volatility contraction pattern (vcp pattern)? It is essentially about appreciating price and volume action as supply diminishes during a price base. Web a volatility contraction pattern is a specific chart pattern within a consolidation period. Web in technical analysis, the volatility contraction pattern (vcp) is a notable concept that traders use to identify potential breakouts in. Web volatility contraction patterns are often found in stocks before an explosive share price gain. When prices decrease in both volatility and volume, the price will form a contracted pattern which is better illustrated using a bollinger band indicator. For a stock to create the proper setup for the vcp, there needs to be demand. For the volatility contraction pattern,. Web the vcp or volatility contraction pattern is a trading tactic coined by professional investor, mark minvervini. Web a volatility contraction pattern is a specific chart pattern within a consolidation period. The main role of the vcp pattern is. It's essentially a supply and demand characteristic that creates this chart pattern. And a lot of it. In simplest words, prices of financial instruments form a contracted pattern when prices move sideways, volatility declines, and volume also decreases. The vcp pattern is one of mark minervini trading strategy which he follows and practice regularly. Web what is the volatility contraction pattern (vcp pattern)? Web what is the volatility contraction pattern? This tutorial covers the criteria of a vcp base, how to filte. Web volatility contraction patterns are often found in stocks before an explosive share price gain. Web in technical analysis, the volatility contraction pattern (vcp) is a notable concept that traders use to identify potential breakouts in stock prices. The main role of the vcp pattern is. Web the vcp or volatility contraction pattern is a trading tactic coined by professional investor, mark minvervini. To that point, there is no easier way to spot that demand than a. Web a volatility contraction pattern (vcp) is a chart consolidation that tightens from left to right within a price base. This means buyers should be active in the particular stock. Web a volatility contraction pattern is a specific chart pattern within a consolidation period. Web what is the volatility contraction pattern? For the volatility contraction pattern, the stock must be in demand. When prices decrease in both volatility and volume, the price will form a contracted pattern which is better illustrated using a bollinger band indicator.How to Day Trade with the Volatility Contraction Pattern (VCP)?

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

How to Day Trade with the Volatility Contraction Pattern (VCP)?

The Volatility Contraction Pattern (VCP) How To Day Trade It TradingSim

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Understanding The Volatility Contraction Pattern TraderLion

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

Volatility Contraction Pattern (VCP) Strategy Dot Net Tutorials

The Volatility Contraction Pattern (VCP) How To Day Trade It TradingSim

It's Essentially A Supply And Demand Characteristic That Creates This Chart Pattern.

It Is Essentially About Appreciating Price And Volume Action As Supply Diminishes During A Price Base.

For A Stock To Create The Proper Setup For The Vcp, There Needs To Be Demand.

Web A Volatility Contraction Pattern Is A Pattern That Forms During A Consolidation Period.

Related Post: