Symmetric Triangle Pattern

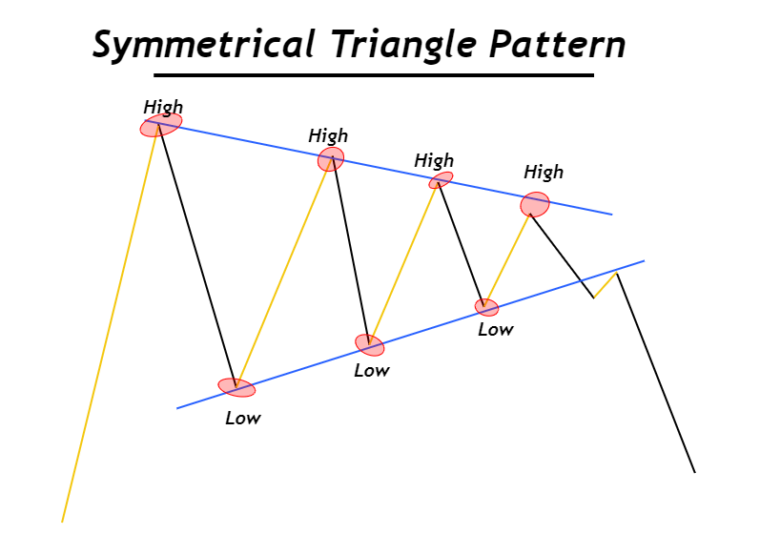

Symmetric Triangle Pattern - Web the symmetrical triangle is a powerful pattern that highlights periods of market consolidation and impending volatility. What is a symmetrical triangle pattern? The symmetrical triangle is usually a continuation pattern. Web what is the symmetrical triangle pattern? Web understand the key differences between the symmetrical triangle and pennant patterns, including how they differ in formation, duration and breakout timing. Web learn how to identify and trade symmetrical triangle patterns, a common chart formation in technical analysis. Web learn how to identify and trade the symmetrical triangle pattern, a common chart pattern that signals the continuation of a trend. It is comprised of price fluctuations where each swing high or swing low is smaller than its. Web a symmetrical triangle pattern is the result of the contraction of volatility in the market. Web a symmetrical triangle is the most common triangle chart pattern. Web the symmetrical triangle pattern is formed by two converging trendlines. Web what is the symmetrical triangle pattern? Web a bull pennant pattern is a technical analysis formation that often precedes a strong upward movement in price. Web the symmetrical triangle pattern is a continuation chart pattern like ascending and descending triangle patterns. Web a symmetrical triangle is the most common triangle chart pattern. Web a symmetrical triangle pattern is the result of the contraction of volatility in the market. In this case, the tiling of the line.ababababababa… can be. Web a symmetrical triangle (aka coiling, contracting triangle) is one of the most common chart patterns among many others. Web what is a symmetrical triangle pattern? It is comprised of price fluctuations where each swing high or swing low is smaller than its. The symmetrical triangle is usually a continuation pattern. These patterns signal a period of. Web a bull pennant pattern is a technical analysis formation that often precedes a strong upward movement in price. A symmetrical triangle is a neutral technical chart pattern that consists of two converging trendlines. Web the symmetrical triangle pattern is a continuation chart pattern like ascending. Web shares of hdfc bank are broadly trading within a symmetrical triangle pattern on the weekly chart and forming a bearish flat and pole pattern on the daily. In this case, the tiling of the line.ababababababa… can be. Web what is a symmetrical triangle chart pattern and how does it work? What is a symmetrical triangle pattern? Web this lesson. Web shares of hdfc bank are broadly trading within a symmetrical triangle pattern on the weekly chart and forming a bearish flat and pole pattern on the daily. Web what is a symmetrical triangle pattern? Web learn how to identify and trade symmetrical triangle patterns, a common chart formation in technical analysis. The upper trendline connects a series of lower. Web a bull pennant pattern is a technical analysis formation that often precedes a strong upward movement in price. Web learn how to identify and trade symmetrical triangle patterns, a common chart formation in technical analysis. Web this lesson will first take you through what a symmetrical triangle chart pattern is and then teach you how to use it to. Web this lesson will first take you through what a symmetrical triangle chart pattern is and then teach you how to use it to trade. Web what is the symmetrical triangle pattern? Web a symmetrical triangle pattern is the result of the contraction of volatility in the market. Web a bull pennant pattern is a technical analysis formation that often. One trendline consists of a. Web understand the key differences between the symmetrical triangle and pennant patterns, including how they differ in formation, duration and breakout timing. Web symmetrical triangle patterns are a bigger overall candlestick pattern. Web what is the symmetrical triangle pattern? A symmetrical triangle is a neutral technical chart pattern that consists of two converging trendlines. A symmetrical triangle is a neutral technical chart pattern that consists of two converging trendlines. The symmetrical triangle (aka symmetrical wedge pattern) is a volatility contraction. These patterns signal a period of. Web a symmetrical triangle pattern is the result of the contraction of volatility in the market. The symmetrical triangle is usually a continuation pattern. Web translational symmetry shows how a tiling is really just one pattern repeated over and over. Web a symmetrical triangle is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. It is comprised of price fluctuations where each swing high or swing low is smaller than its. Web understand the key differences. Web the symmetrical triangle pattern is a continuation chart pattern like ascending and descending triangle patterns. Web the symmetrical triangle is a powerful pattern that highlights periods of market consolidation and impending volatility. The symmetrical triangle (aka symmetrical wedge pattern) is a volatility contraction. Web this lesson will first take you through what a symmetrical triangle chart pattern is and. Web what is the symmetrical triangle pattern? Web what is a symmetrical triangle pattern? Web a symmetrical triangle (aka coiling, contracting triangle) is one of the most common chart patterns among many others. In other words, volatility is constantly decreasing. In the following lessons, we will then introduce you. Read for performance statistics, trading tactics, id guidelines. Web a symmetrical triangle is a chart pattern characterized by two converging trend lines connecting a series of sequential peaks and troughs. Web a symmetrical triangle is the most common triangle chart pattern. In the following lessons, we will then introduce you. Web symmetrical triangle patterns are a bigger overall candlestick pattern. Web shares of hdfc bank are broadly trading within a symmetrical triangle pattern on the weekly chart and forming a bearish flat and pole pattern on the daily. Web a symmetrical triangle pattern is the result of the contraction of volatility in the market. Web what is a symmetrical triangle pattern? Web translational symmetry shows how a tiling is really just one pattern repeated over and over. It represents a pause in the existing uptrend after which the. Web learn how to identify and trade the symmetrical triangle pattern, a common chart pattern that signals the continuation of a trend. Web what is a symmetrical triangle chart pattern and how does it work? Web symmetrical triangles are chart patterns that have prices forming between converging trendlines. The symmetrical triangle is usually a continuation pattern. Web what is the symmetrical triangle pattern? These patterns signal a period of.3 Triangle Patterns Every Forex Trader Should Know

Symmetrical Triangle Chart Pattern Profit and Stocks

Basic Chart Patterns Symmetrical Triangle Chart Pattern

Symmetrical Triangle Pattern Definition & Interpretation Angel One

Symmetrical Triangle Pattern A Price Action Trader's Guide ForexBee

Symmetrical Triangle Chart Pattern Formation Example StockManiacs

How to Trade Symmetrical Triangle Pattern breakout in Stock Market

Symmetrical Triangle General Patterns ThinkMarkets

What Is Symmetrical Triangle Pattern Formation & Trading ELM

Symmetrical Triangle Pattern Meaning, Features & Example Finschool

The Symmetrical Triangle (Aka Symmetrical Wedge Pattern) Is A Volatility Contraction.

In Other Words, Volatility Is Constantly Decreasing.

What Is A Symmetrical Triangle Pattern?

Web Learn How To Identify And Trade Symmetrical Triangle Patterns, A Common Chart Formation In Technical Analysis.

Related Post: