Rounding Top Pattern

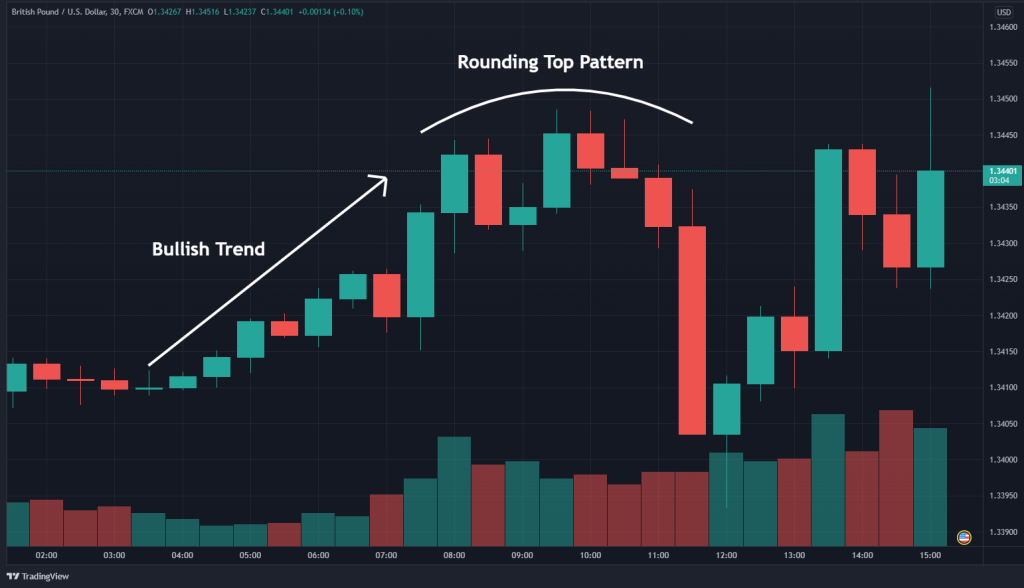

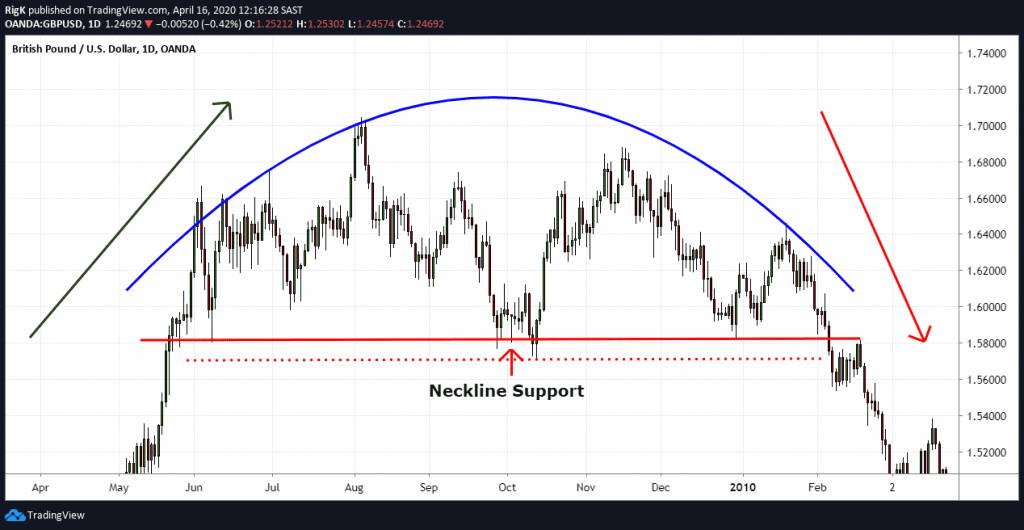

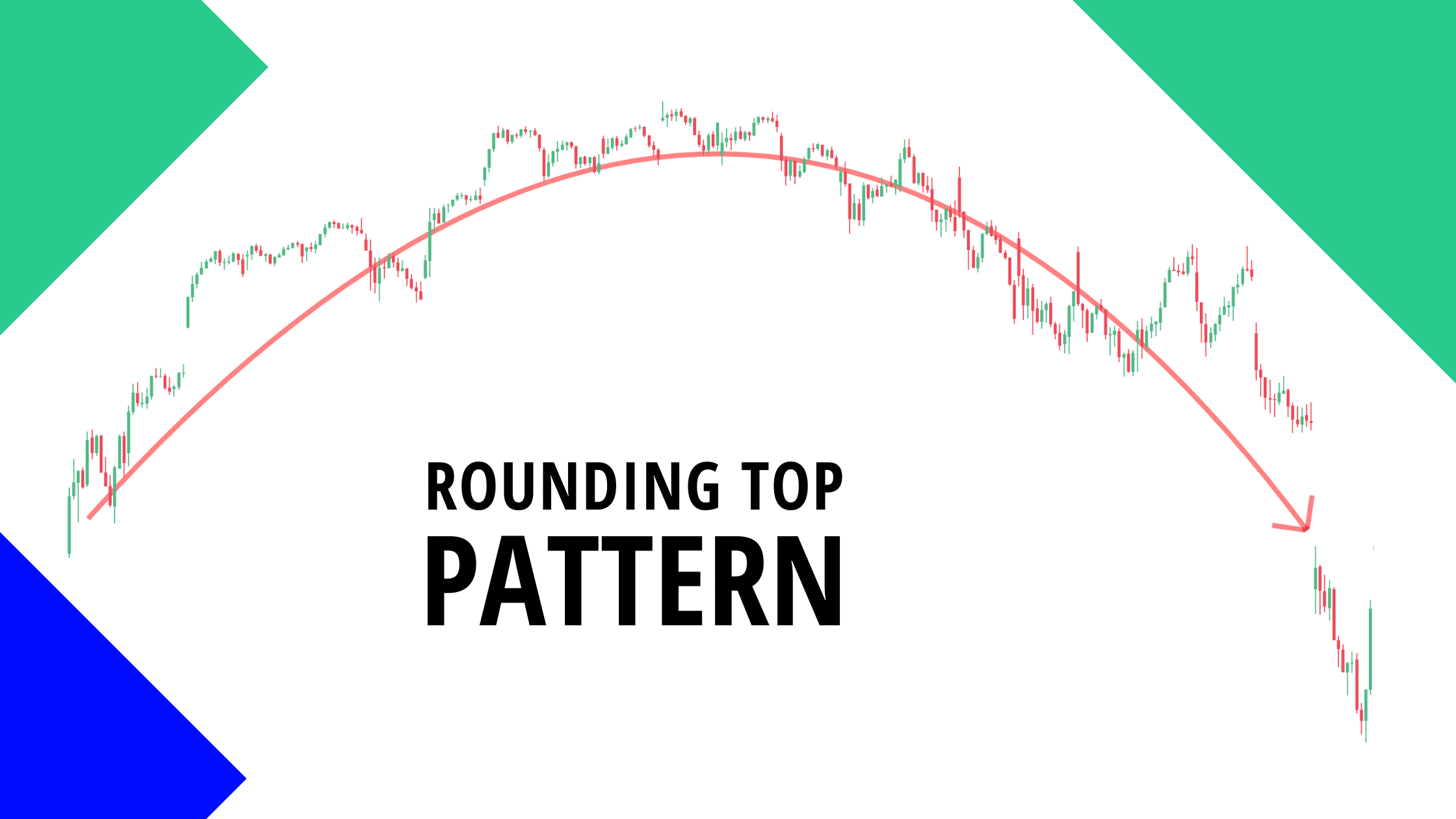

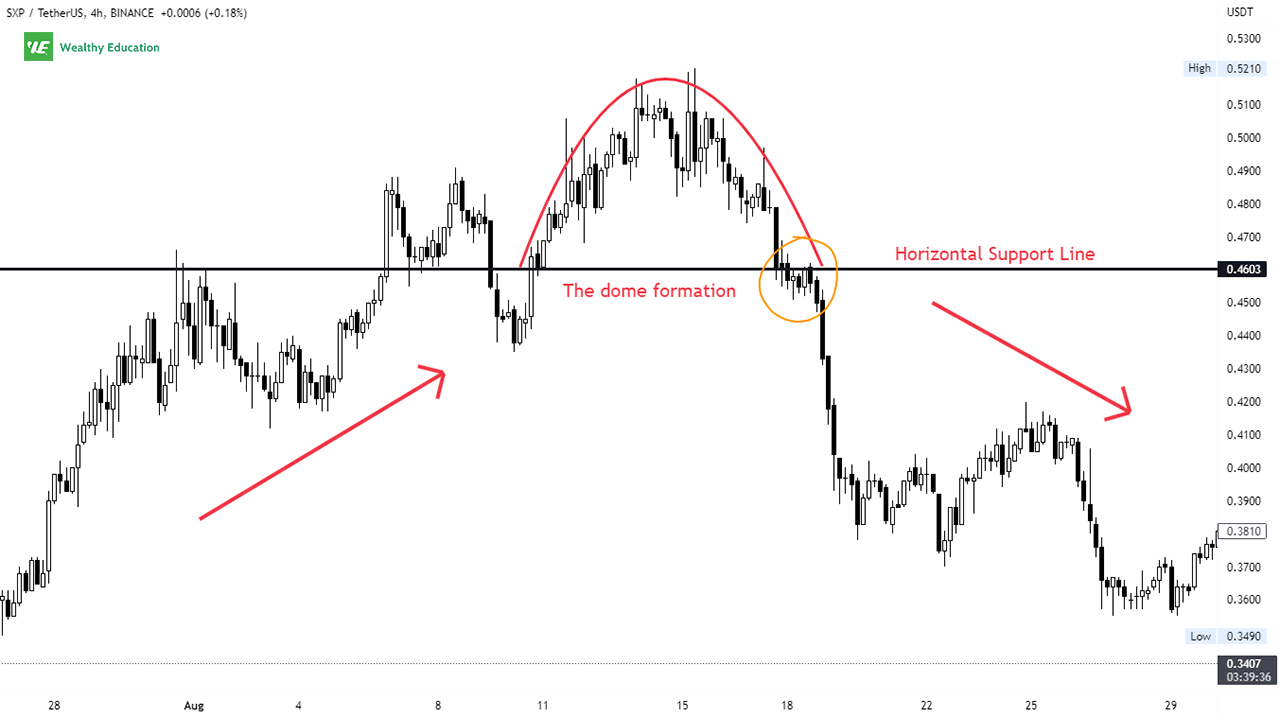

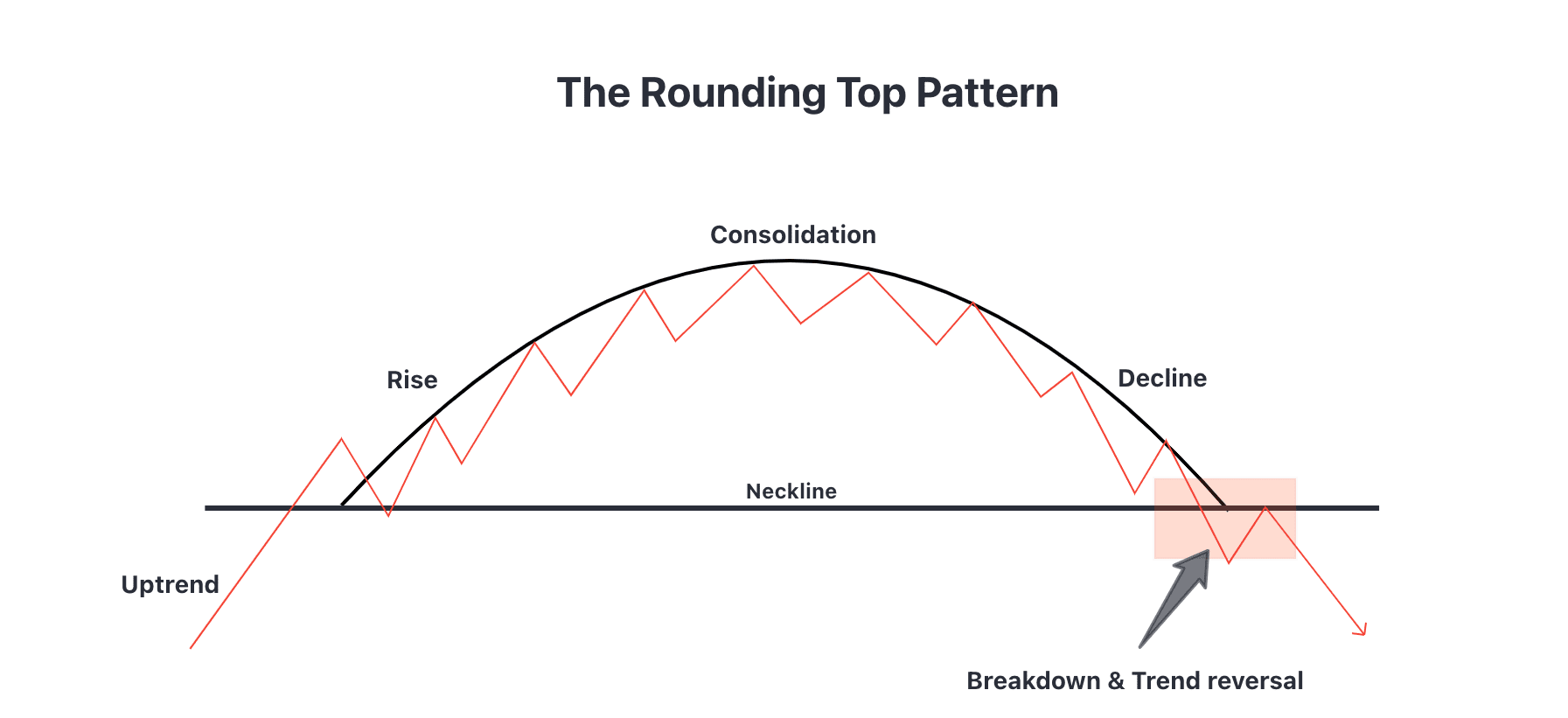

Rounding Top Pattern - Web a rounding top chart pattern indicates a potential reversal of a prior uptrend and is often viewed as a bearish signal in technical analysis. It denotes the stop of an uptrend and the likely start of a downtrend. • ideally, volume and price will move in tandem. Special agent, said the image captured by doug mills, a new york times photographer, seems to show a bullet streaking past former president donald j. Web the rounded top and bottom are reversal patterns designed to catch the end of a trend and signal a potential reversal point on a price chart. • a rounding bottom is a bearish reversal pattern that resembles the shape of the inverted u. Web the rounding top pattern is characterized by a gradual curve in the price action that looks like a rounded top, hence the name. The rounded bullish peaks mark the end of. Unlike rounding bottom, the price objective is calculated according to the traditional pendulum rule. Both these patterns are designed to identify the end of a price trend, and technical traders use them frequently to supplement their hypothesis of an upcoming reversal in trend. As you can see in the gbp/usd chart below, it has the shape of an inverted parabola. Special agent, said the image captured by doug mills, a new york times photographer, seems to show a bullet streaking past former president donald j. Web michael harrigan, a retired f.b.i. Web what is the rounding top pattern in trading? It denotes the stop of an uptrend and the likely start of a downtrend. • rounding tops are found at the end of an uptrend trend and signify a reversal • it is also referred to as an inverted saucer. Topping patterns are critical to recognize prior to the stock turning down, especially in the modern market structure, where hft algos can trigger sudden price collapses within seconds of. The result is typically a slow reversal in the direction of price, creating a “u” shape that looks much like a rounded hill. Web what is a rounding top pattern? Web a rounding top is a price pattern used in technical analysis. Web a rounding top is a price pattern used in technical analysis. Web what is a rounding top? This formation occurs after an uptrend and is typically characterized by diminishing buying pressure as the security approaches its resistance level. Web mmm stock chart shows a rounding top developing. Special agent, said the image captured by doug mills, a new york. • a rounding top is a chart pattern that graphically forms the shape of an inverted u. Web the rounding top is a reversal pattern that occurs during an uptrend. • rounding top pattern occur at the end of long uptrends and indicate a potential reversal. Here's a detailed explanation of what a rounding top pattern indicates: Web a rounding. Web rounding tops are large chart patterns that are an inverted bowl shape. Topping patterns are critical to recognize prior to the stock turning down, especially in the modern market structure, where hft algos can trigger sudden price collapses within seconds of. Web one type of chart pattern that is often used to identify potential reversal points on a price. • a rounding bottom is a bearish reversal pattern that resembles the shape of the inverted u. It is calculated by measuring the depth of the u and then plotting that on the neck line. The rounded top pattern appears as an inverted 'u' shape and is often referred to as an ‘inverse saucer’. Web the rounded top and bottom. Web a rounding top pattern is a price pattern which forms a downtrend sloping curve when graphed. It is also referred to as “inverse saucer” as it looks similar to an inverted “u” shape. Web in technical analysis, a rounding top pattern, also known a a rounded top, is a bearish reversal price pattern that forms at the end of. Appearing this structure began with an uptrend, in which bulls are in control. Web a rounding top is a bearish reversal pattern that resembles the shape of an inverted “u” and signals a potential shift in market sentiment. The rounding top has long been considered as a reversal pattern. Web a rounding top might be a bullish continuation pattern or. Both these patterns are designed to identify the end of a price trend, and technical traders use them frequently to supplement their hypothesis of an upcoming reversal in trend. Observe an extended period of stalled price action. The rounding top pattern typically forms after a sustained uptrend in the price of an asset. A rounding top pattern is a technical. This formation occurs after an uptrend and is typically characterized by diminishing buying pressure as the security approaches its resistance level. A rounding top pattern is a technical trading term that refers to the price chart of an investment vehicle, typically stocks, indexes or forex currency pairs. Rounding bottoms form an inverted ‘u’ shape and indicate the end of an. Web what is the rounding top pattern in trading? Read for performance statistics, trading tactics, id guidelines and more. Web a rounding top pattern is a price pattern which forms a downtrend sloping curve when graphed. • a rounding top is a chart pattern that graphically forms the shape of an inverted u. • ideally, volume and price will move. Web in technical analysis, a rounding top pattern, also known a a rounded top, is a bearish reversal price pattern that forms at the end of a bullish uptrend. Web a rounding top pattern is a bearish reversal structure forming at the end of an uptrend. The rounded top pattern appears as an inverted 'u' shape and is often referred. Web the rounding top pattern is characterized by a gradual curve in the price action that looks like a rounded top, hence the name. It notifies traders a likely reversal point on a price chart. Rounded top pattern is represented in form of an inverted ‘u’ shape and is also known as an ‘inverse saucer’. Web michael harrigan, a retired f.b.i. Special agent, said the image captured by doug mills, a new york times photographer, seems to show a bullet streaking past former president donald j. Web a rounding top pattern is a price pattern which forms a downtrend sloping curve when graphed. Web what is a rounding top pattern? Web in technical analysis, a rounding top pattern, also known a a rounded top, is a bearish reversal price pattern that forms at the end of a bullish uptrend. Web mmm stock chart shows a rounding top developing. It is also referred to as “inverse saucer” as it looks similar to an inverted “u” shape. Follow the steps below to distinguish the rounding top: The pattern is often seen as a potential reversal signal, as it indicates that buying pressure is gradually being replaced by selling pressure resulting in a bearish trend. Web the rounded top are reversal patterns used to signal the end of a trend. It denotes the stop of an uptrend and the likely start of a downtrend. Rounding tops are usually formed at the end of the extended uptrend, indicating early signs of a possible reversal. The rounding top pattern typically forms after a sustained uptrend in the price of an asset.How To Trade The Rounding Top Chart Pattern (in 3 Steps)

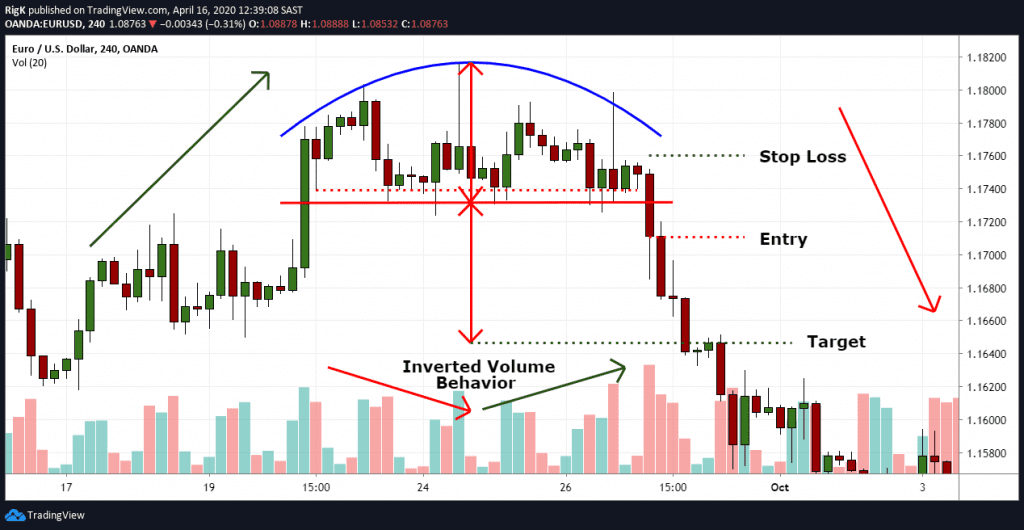

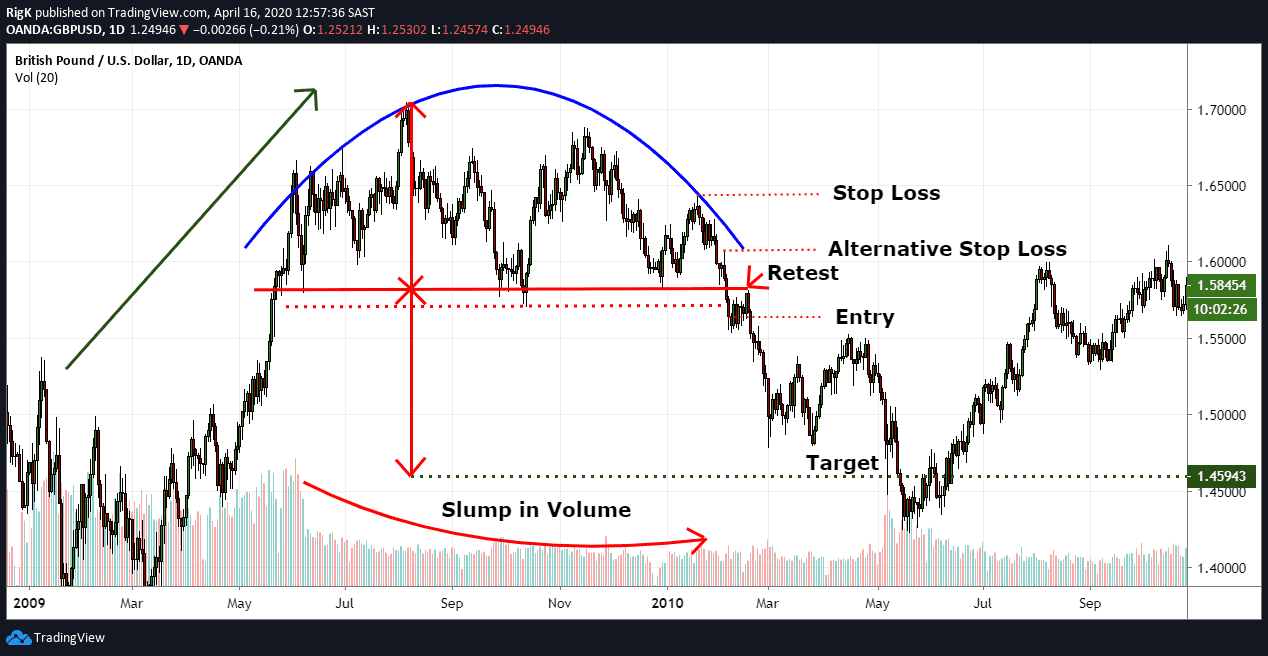

How to Trade Rounding Top and Rounding Bottom Chart Patterns Forex

The Rounding Top Chart Pattern (Explained With Examples)

The Rounding Top Chart Pattern (Explained With Examples)

What is a Rounding Top & How to Trade it Best? PatternsWizard

Rounding Top Pattern The Definitive Trading Guide For Stocks

Rounding Top Pattern (Updated 2023)

The Rounding Top Chart Pattern (Explained With Examples)

Rounding top chart pattern Best guide with 2 examples!

The Rounding Top Chart Pattern (Explained With Examples)

Here's A Detailed Explanation Of What A Rounding Top Pattern Indicates:

Identify An Uptrend In Price Action.

Read For Performance Statistics, Trading Tactics, Id Guidelines And More.

The Result Is Typically A Slow Reversal In The Direction Of Price, Creating A “U” Shape That Looks Much Like A Rounded Hill.

Related Post: