Reverse Head And Shoulders Pattern

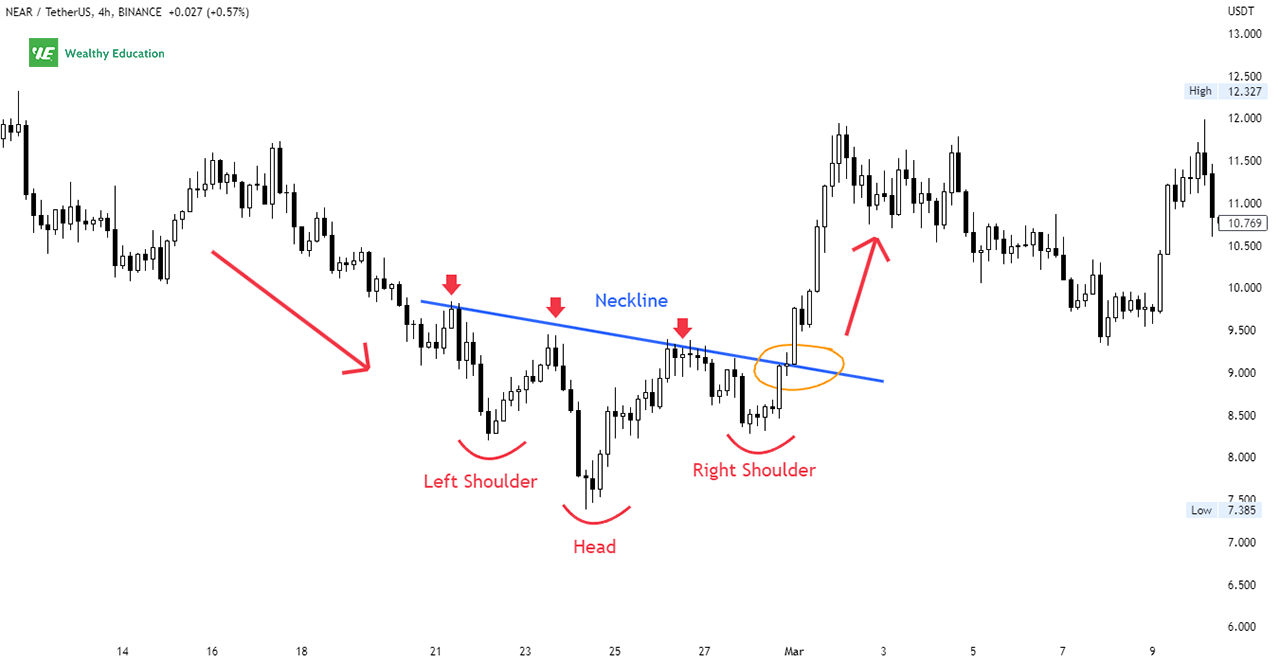

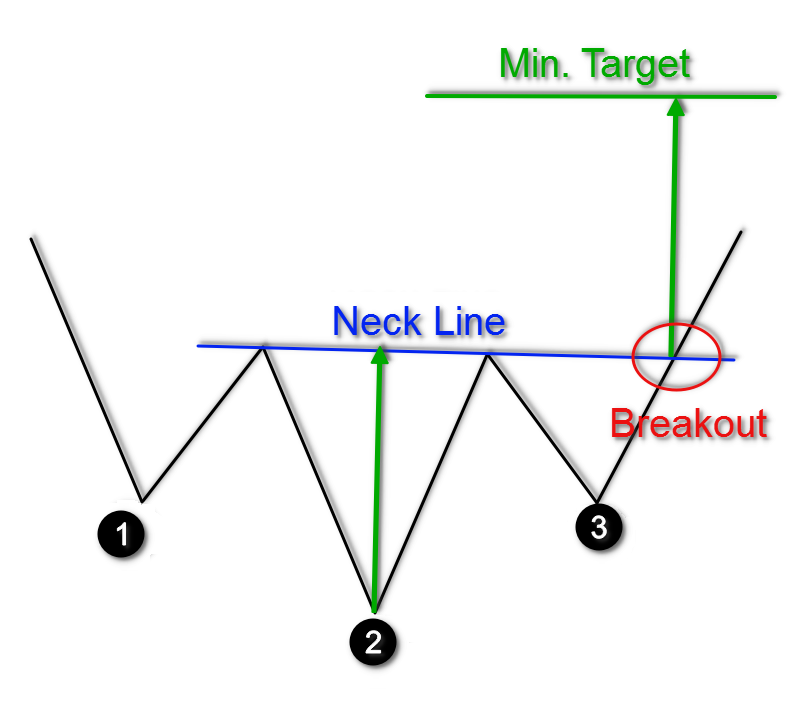

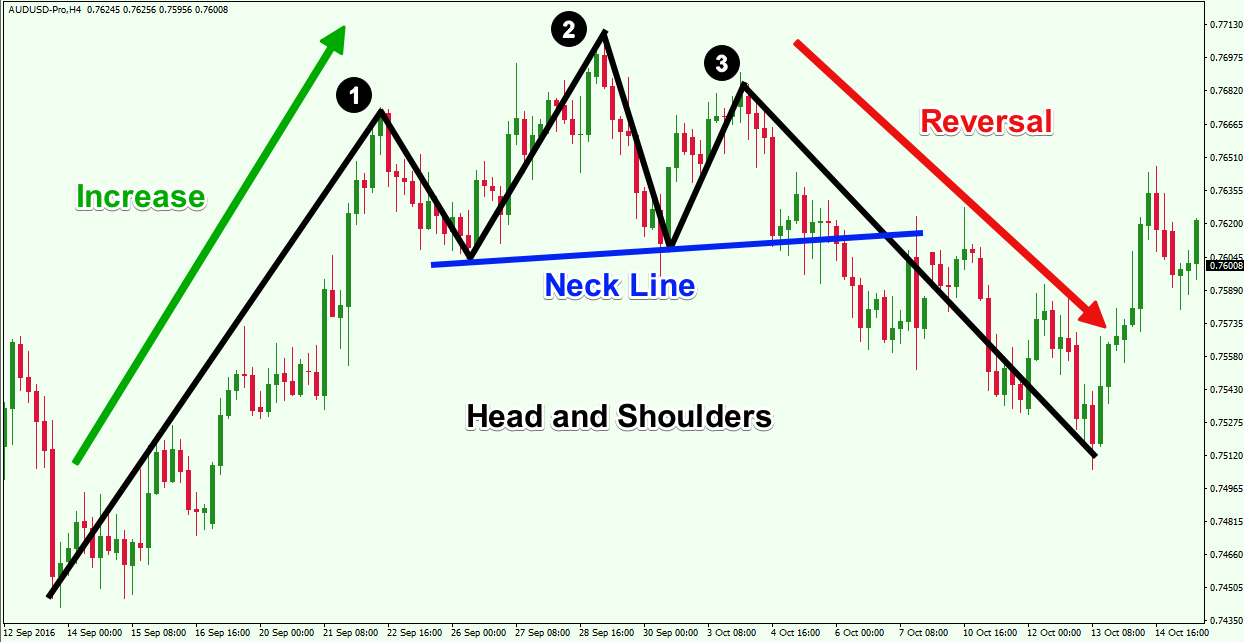

Reverse Head And Shoulders Pattern - Web inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend. It is also one of the most profitable chart patterns, with an average 45% price increase per trade. Web the left arm can remain down at your side or place hand on hip. Once standing, pull your shoulders back and down to prevent from rolling forward. Web inverse head and shoulders pattern. Technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap,. This reversal signals the end of. Web step one foot slightly back behind you with a bent knee and the weight on the ball of the foot. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. The height of the pattern plus the breakout price should be your target price using this indicator. Web the left arm can remain down at your side or place hand on hip. There are four main components of the head and shoulders pattern shown in the image below. The pattern appears as a head, 2 shoulders, and neckline in an inverted position. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. Technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap,. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself. Web step one foot slightly back behind you with a bent knee and the weight on the ball of the foot. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. The pattern consists of 3. Following this, the price generally goes to the upside and starts a new uptrend. It is of two types: The first and third lows are called shoulders. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself. However, if traded correctly, it. Once standing, pull your shoulders back and down to prevent from rolling forward. Price declines followed by a price bottom, followed by an. This reversal signals the end of. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. Web an inverse head and shoulders pattern. Once standing, pull your shoulders back and down to prevent from rolling forward. The inverse head and shoulders pattern is a reversal pattern in stock trading. There are four main components of the head and shoulders pattern shown in the image below. The right shoulder on these patterns typically is higher than the left, but many times it’s equal. Web. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Web inverted head and shoulders is a reversal pattern formed by three. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). The pattern appears as a head, 2 shoulders, and neckline in an inverted position. Both “inverse” and “reverse” head and shoulders patterns are the same. Web the inverse head and shoulders,. Web the left arm can remain down at your side or place hand on hip. Web an inverse head and shoulders pattern is a technical analysis chart pattern that signals a potential trend reversal from a downtrend to an uptrend. The height of the pattern plus the breakout price should be your target price using this indicator. Web the inverse. This reversal could signal an. The pattern resembles the shape of a person’s head and two shoulders in an inverted position, with three consistent lows and peaks. Hinge at the hips while keeping the weight in the supporting leg, lowering the weight towards the. Formation of the inverse head and shoulders pattern seen at market bottoms: This reversal signals the. Web step one foot slightly back behind you with a bent knee and the weight on the ball of the foot. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. As such,. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. However, if traded correctly, it allows you to identify high probability breakout trades, catch the start of a new trend, and even “predict” market bottoms ahead of time. As such, it is a bearish pattern that. Web what is an inverse head and shoulders pattern? Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low peaks that make up the left and right shoulders. The pattern appears as a head, 2 shoulders, and neckline in an inverted position.. The height of the pattern plus the breakout price should be your target price using this indicator. The first and third lows are called shoulders. Price declines followed by a price bottom, followed by an. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Head & shoulder and inverse head & shoulder. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. This reversal signals the end of. Web step one foot slightly back behind you with a bent knee and the weight on the ball of the foot. Web the inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. It is the opposite of the head and shoulders chart pattern, which is a. Web inverse head and shoulders pattern. Web what is an inverse head and shoulders pattern? The right shoulder on these patterns typically is higher than the left, but many times it’s equal. Web inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend. This reversal could signal an. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis.Reverse Head And Shoulders Pattern (Updated 2023)

Must be Profit if you identify Resistance and Support Line (Part13

Head and Shoulders Trading Patterns ThinkMarkets EN

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Reverse Head And Shoulders Pattern Stocks

How to Trade the bearish Head and Shoulders Pattern in Best Forex

headandshouldersreversalchartpattern Forex Training Group

Reverse Head And Shoulders Pattern Stocks

Head and Shoulders Reversal Pattern Lesson 5 Part 1a Getting

Web What Is A Head And Shoulders Pattern?

Formation Of The Inverse Head And Shoulders Pattern Seen At Market Bottoms:

The Pattern Appears As A Head, 2 Shoulders, And Neckline In An Inverted Position.

The Pattern Resembles The Shape Of A Person’s Head And Two Shoulders In An Inverted Position, With Three Consistent Lows And Peaks.

Related Post: