Reversal Flag Pattern

Reversal Flag Pattern - It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. They usually reverse the current price trend, causing a fresh move in the opposite direction. What do reversal patterns indicate? Here is an overview of each of these types and some examples. What you will learn here. Web nowadays, biden is an enthusiastic advocate of additional gun control, including universal background checks for gun buyers, a crackdown on homemade firearms, red flag laws, and a federal. Reversal chart patterns can also be trend continuation patterns—the context is what. Traders can use a variety of signals in combination with a flag pattern to help confirm its validity and improve the chances of a successful trade. Web in this article, we will explore the definition and characteristics of flag chart patterns, delve into both bullish and bearish flag patterns, discuss potential trading strategies, and provide tips for successful flag trading. Use volume confirmation for better sense of breakout. Web discover the top 12 trend reversal patterns to enhance your trading skills and market analysis. Web the reversal patterns describe the change in trend by moving against the current direction. Web reversal patterns are often seen at the end of a trend when the market is about to change direction. Web a reversal is a trend change in the price of an asset. For example, a chart can show a double bottom but this reversal chart pattern can be transformed into a triple bottom or a range, hence the need to wait for the bullish/bearish. Web common continuation patterns include triangles, flags, pennants, and rectangles. Master the best chart and candlestick patterns for spotting potential market reversals with accuracy and confidence. Web nowadays, biden is an enthusiastic advocate of additional gun control, including universal background checks for gun buyers, a crackdown on homemade firearms, red flag laws, and a federal. What do reversal patterns indicate? This pattern consists of three peaks, with the middle peak being the highest. Web reversal chart patterns. Some common reversal chart patterns are the inverse head and shoulders, ascending triangle, and double bottom; Web reversal patterns are often seen at the end of a trend when the market is about to change direction. Once a trend ends, traders can look. A crucial criterion to keep in mind when choosing trend reversal indicator or indicators in general. Web the break of structure (breakout of the trend line with a flag pattern) provides a powerful entry point for trading trend reversals. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets,. On the other hand, reversal patterns are opposite to continuation patterns. Final flag reversals are common because every reversal follows some kind of flag and therefore is a type of final flag reversal. Web flag patterns are followed by representative volume indicators and price action. Web in this article, we will explore the definition and characteristics of flag chart patterns,. I'll explain what each reversal pattern indicates, with visual chart examples. Web in this article, we will explore the definition and characteristics of flag chart patterns, delve into both bullish and bearish flag patterns, discuss potential trading strategies, and provide tips for successful flag trading. Web the break of structure (breakout of the trend line with a flag pattern) provides. Web a price pattern that signals a change in the prevailing trend is known as a reversal pattern. Web in this article, we will explore the definition and characteristics of flag chart patterns, delve into both bullish and bearish flag patterns, discuss potential trading strategies, and provide tips for successful flag trading. Reversal chart patterns can also be trend continuation. They usually reverse the current price trend, causing a fresh move in the opposite direction. Here is an overview of each of these types and some examples. This pattern consists of three peaks, with the middle peak being the highest. Web the reversal patterns describe the change in trend by moving against the current direction. What are the types of. Web this week's action provided confirmation, and both the monthly and weekly charts have made potential reversal patterns. Web a reversal chart pattern is validated only when the price line exits the pattern (breakage of the neck line or the bearish downward/bullish upwards slant). Web trading a major trend reversal pattern is an attempt to enter at the start of. Flag patterns signify trend reversals after a period of consolidation. I'll explain what each reversal pattern indicates, with visual chart examples. For example, a chart can show a double bottom but this reversal chart pattern can be transformed into a triple bottom or a range, hence the need to wait for the bullish/bearish. Web common continuation patterns include triangles, flags,. Web common continuation patterns include triangles, flags, pennants, and rectangles. Web discover the top 12 trend reversal patterns to enhance your trading skills and market analysis. Web all reversal chart patterns like the hammer, hanging man, and morning/evening star formations. 1) trending vs retracement move 2) lower highs and higher lows 3) time factor; Since traders are entering before the. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Web flag patterns are followed by representative volume indicators and price action. Web common continuation patterns include triangles, flags, pennants, and rectangles. Web reversal chart patterns. Web reversal patterns are often seen at. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. The trend pauses for a while and then heads in the opposite direction. Web reversal chart patterns. Web this week's action provided confirmation, and both the monthly and weekly charts have made potential reversal patterns. Traders can use a variety of signals in combination with a flag pattern to help confirm its validity and improve the chances of a successful trade. Once a trend ends, traders can look at the chart and see the final flag in the trend. Web reversal patterns are often seen at the end of a trend when the market is about to change direction. An uptrend is created by higher swing highs and higher swing. These patterns signify periods where the bulls or the bears have run out of steam. Web flag patterns are followed by representative volume indicators and price action. What do reversal patterns indicate? Here is an overview of each of these types and some examples. Learn how to trade bull flag and bear flag chart patterns the right way. Share the reversal chart patterns cheat sheet pdf for. The market exhibits a bilateral pattern when buyers and. Web common continuation patterns include triangles, flags, pennants, and rectangles.Reverse flag pattern for now! for BITSTAMPBTCUSD by WoodLandSprite

Bullish flag pattern reversal in SUNPHARMA YouTube

Gold Reversal + Bearish Flag Pattern Contiuation for FX_IDCXAUUSD by

NZDJPY Trend Reversal With A Flag Pattern for FXNZDJPY by FXTurkey

Flag Pattern Full Trading Guide with Examples

EURGBP REVERSE FLAG PATTERN for FXEURGBP by MbaliAcademy — TradingView

Bullish Wealth 🇮🇳 on Instagram "📈📉 Ultimate Chart Pattern Cheat Sheet

How To Trade Blog What Is Flag Pattern? How To Verify And Trade It

Flag Pattern Forex Trading

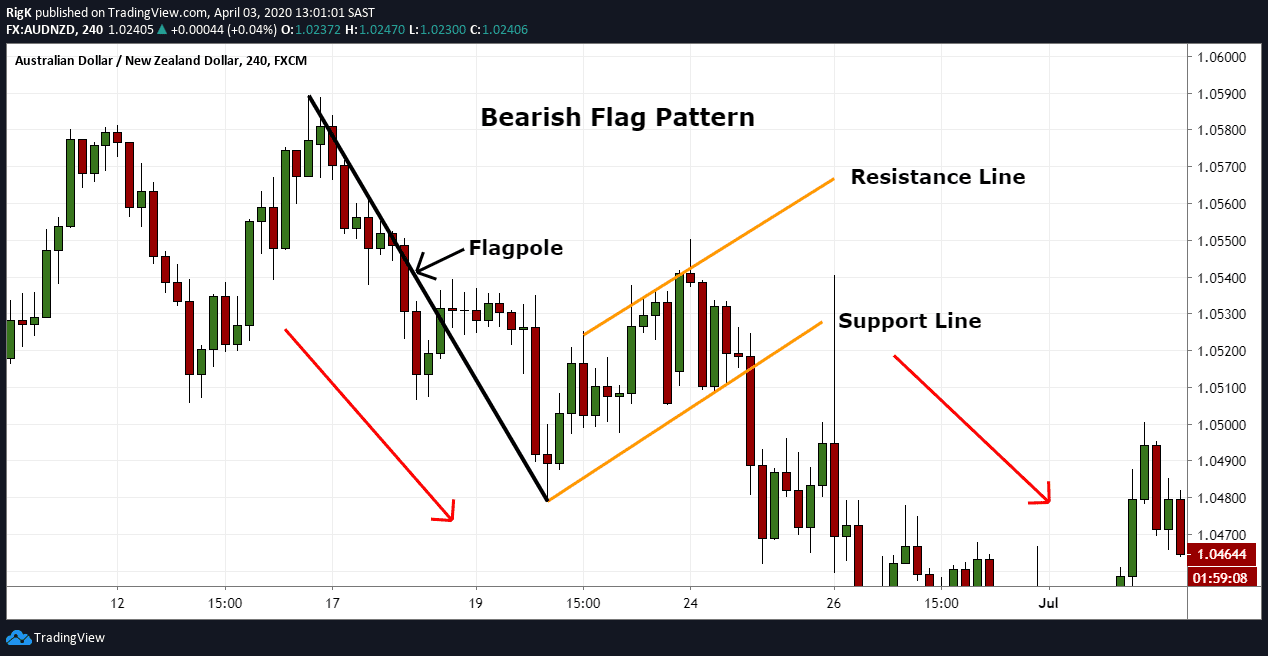

How to Trade Bear Flag Pattern Bearish Flag Chart Pattern

Web A Flag Pattern Is A Technical Analysis Chart Pattern That Can Be Observed In The Price Charts Of Financial Assets, Such As Stocks, Currencies, Or Commodities.

This Pattern Consists Of Three Peaks, With The Middle Peak Being The Highest.

These Patterns Identify That Either Bulls Or Bears Are Losing The Battle.

What You Will Learn Here.

Related Post: