Candlestick Patterns Hammer

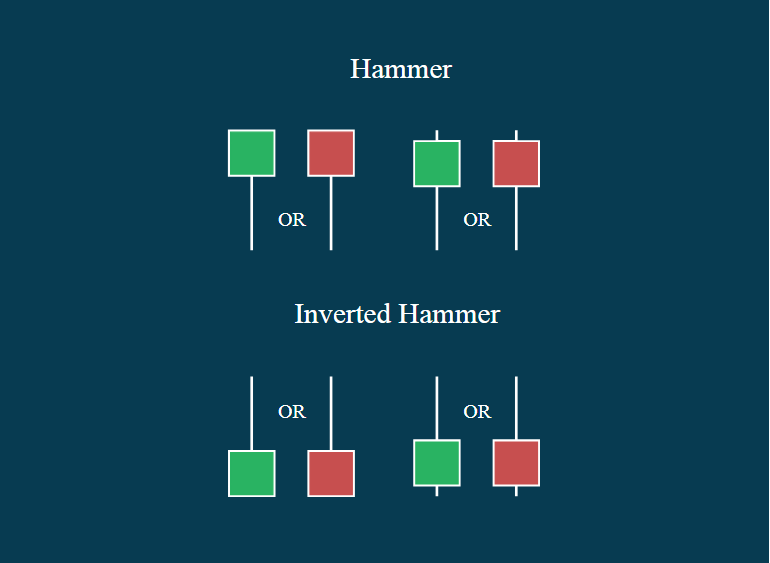

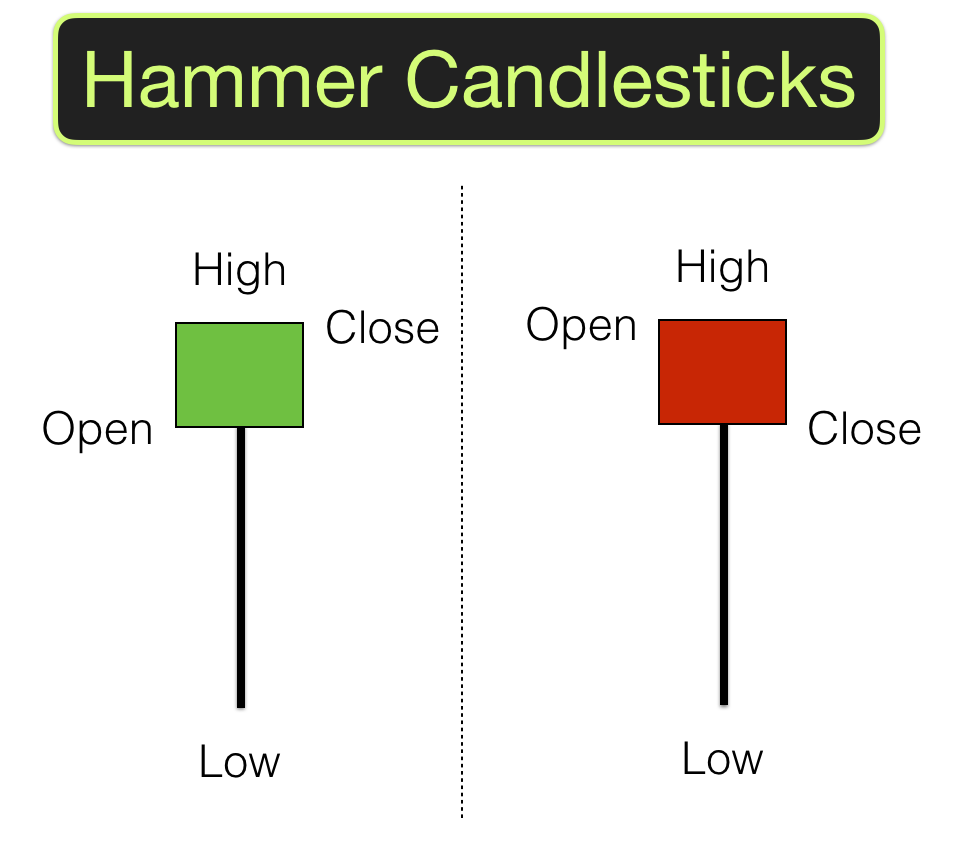

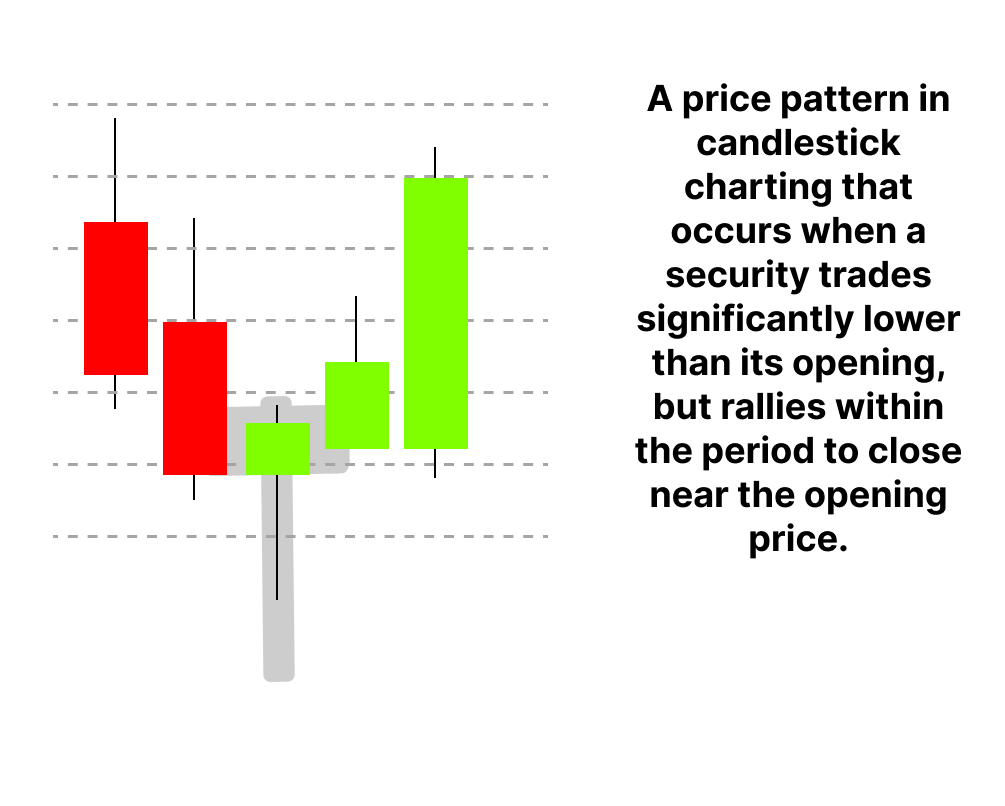

Candlestick Patterns Hammer - Web the hammer and the inverted hammer candlestick patterns are among the most popular trading formations. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. Web a hammer candle is a popular pattern in chart technical analysis. A small real body, long. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. The hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. Web hammer candlestick pattern consists of a single candlestick & its name is derived from its shape like a hammer having long wick at bottom and a little body at top. The most significant drawback of this classic chart. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. Web the hammer pattern is one of the first candlestick formations that price action traders learn in their career. They consist of small to medium size lower shadows, a real. Web a hammer candlestick is a term used in technical analysis. It is often referred to as a bullish pin bar, or bullish rejection candle. Web chantilly in sterling by gorham list of in stock items. Our guide includes expert trading tips and examples. The candle has a small body;. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close. Candlestick patterns are a key part of trading. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. The hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. Web hammer candlesticks are a popular reversal pattern formation found at the bottom of downtrends. Web hammer candlestick pattern consists of a single candlestick & its name is derived from its shape like a hammer having long wick at bottom and a little body at top. Web the hammer candlestick pattern is a bullish candlestick that is found at a. Web what is the hammer candlestick pattern? The hammer candlestick pattern is formed by one single candle. The hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close. The. Web a hammer candle is a popular pattern in chart technical analysis. It is characterized by a small body and a long lower wick, resembling a hammer, hence its. It signals that the market is about to change trend direction and advance. Published on december 9, 2023. Web the hammer candlestick pattern is a single candle formation that occurs in. Both are reversal patterns, and they occur at the bottom of a. No matter your astrological experience or knowledge level, you're warmly invited to the. A small real body, long. Web a hammer candle is a popular pattern in chart technical analysis. The hammer candlestick pattern is formed by one single candle. Web using candlestick patterns with key areas of value—such as support and resistance levels, trendlines, and moving averages—is vital to success. No matter your astrological experience or knowledge level, you're warmly invited to the. This candlestick pattern is a bullish reversal single candle. Web the hammer and the inverted hammer candlestick patterns are among the most popular trading formations. It. Web what is the hammer candlestick pattern? Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close. The hammer candlestick pattern is formed by one single candle. Web hammer candlestick pattern consists of a single candlestick & its name is derived from. This pattern typically appears when a. Web the hammer pattern is one of the first candlestick formations that price action traders learn in their career. Frequently asked questions (faqs) what is a hammer candlestick pattern? Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. Web using candlestick patterns with key areas of value—such. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. Web a hammer candle is a popular pattern in chart technical analysis. This candlestick pattern is a bullish reversal single candle. Web chantilly in sterling by gorham list of in stock items. Candlestick patterns are a key part of trading. A small real body, long. It manifests as a single. This pattern typically appears when a. It is often referred to as a bullish pin bar, or bullish rejection candle. All items below which are previously owned, come buffed and polished to look like new with a 100% money back. Candlestick patterns are a key part of trading. We aid in the selection of. Our guide includes expert trading tips and examples. All items below which are previously owned, come buffed and polished to look like new with a 100% money back. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. Web what is the hammer candlestick pattern? Web a hammer is a bullish reversal candlestick pattern that forms after a decline in price. It signals that the market is about to change trend direction and advance. Candlestick patterns are a key part of trading. Small candle body with longer lower shadow, resembling a hammer, with minimal (to zero) upper shadow. A small real body, long. This candlestick pattern is a bullish reversal single candle. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close. Frequently asked questions (faqs) what is a hammer candlestick pattern? Our guide includes expert trading tips and examples. The candle has a small body;. The hammer candle is another japanese candlestick pattern among these 35 powerful candlestick patterns. The hammer candlestick pattern is. Web learn how to use the hammer candlestick pattern to spot a bullish reversal in the markets. The hammer candlestick pattern is formed by one single candle.Candlestick Patterns The Definitive Guide (2021)

Hammer Candlestick Pattern Trading Guide

Hammer Candlestick Pattern Trading Guide

Hammer Candlestick Patterns (Types, Strategies & Examples)

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Mastering the Hammer Candlestick Pattern A StepbyStep Guide to

Hammer Candlestick What Is It and How to Use It in Trend Reversal

Hammer Candlesticks Shooting Star Candlesticks

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

The Hammer Signals That Price May Be About To Make A Reversal Back Higher After A Recent.

Web Hammer Heads Gift & Smoke Shop, Llc Has Been Set Up 7/18/2012 In State Fl.

No Matter Your Astrological Experience Or Knowledge Level, You're Warmly Invited To The.

Web Hammer Candlesticks Are A Popular Reversal Pattern Formation Found At The Bottom Of Downtrends.

Related Post: